The DeFi Debrief

- DeFi Education Fund

- Jul 21

- 7 min read

Week of 7/21/25: Crypto Week in Washington Overview; Reintroduction of Keep Your Coins Act; Senate Ag Hearing; Ways & Means Oversight Hearing; Storm Trial Update

Crypto Week in Washington

Last week, the House of Representatives hosted Crypto Week, advancing three major digital-asset focused bills: the Guiding and Establishing National Innovation in U.S. Stablecoins (GENIUS) Act, the Digital Asset Markets Clarity Act (a regulatory framework for digital asset market structure), and the Anti-CBDC Surveillance State Act (banning a Fed-issued central bank digital currency).

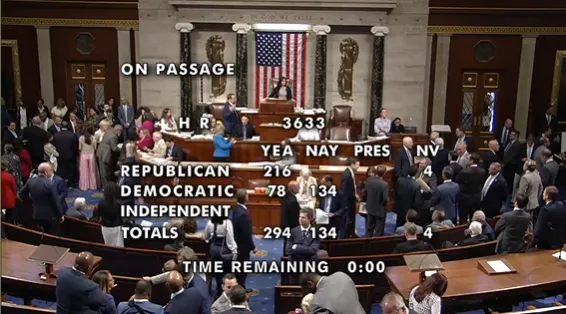

The GENIUS Act passed the House on July 17 with an overwhelming bipartisan supermajority vote of 308-122. That same day, the House passed the Anti-CBDC Surveillance State Act, with a vote of 219–210, and the Clarity Act, with a bipartisan vote of 294–134. On Friday, July 18, President Trump officially signed the GENIUS Act into law.

For a play-by-play of the victories secured during Crypto Week, read more below.

President Trump Signs the GENIUS Act into Law

On July 18, the 2025 Guiding and Establishing National Innovation in U.S. Stablecoins (GENIUS) Act was signed into law by President Trump. GENIUS is the first regulatory framework for digital assets to become U.S. law.

The GENIUS Act, now controlling federal law, establishes a framework for the issuance and regulation of payment stablecoins in the U.S. It sets requirements for reserve backing, transparency, consumer protection, and compliance with anti-money laundering laws, while also creating pathways for federal and state-level stablecoin issuers.

GENIUS is significant for DeFi; for background on the GENIUS Act, and how it will play a critical role in the future of DeFi, you can read DEF’s blog. Stay tuned for DEF updates and analysis on what happens now that GENIUS is the law.

DeFi Education Fund is grateful to the lawmakers in both the Senate and House, along with their dedicated staff, for their commitment to properly distinguishing between centralized and decentralized systems and technologies. Thank you for your efforts in advancing this landmark legislation into law. For DEF’s full statement on the bill’s passage, click here.

The House Passes the CLARITY Act

The U.S. House advanced the CLARITY Act, legislation to establish a market structure framework for digital assets in the United States. The legislation is now headed to the Senate, who is expected to release a discussion draft of their regulatory framework imminently.

The latest draft of CLARITY represents meaningful progress towards achieving greater regulatory clarity and critical protections for DeFi developers, users, and technology in the United States. For an in-depth analysis of the CLARITY Act and what it means for DeFi, read DEF’s blog here.

Amendments to CLARITY

On July 14th, when the CLARITY Act was advanced to the House floor out of the House Rules Committee, several amendments were considered to the base text of the legislation. These amendments included a key manager’s amendment from House Financial Services Committee Chairman French Hill (R-AR) and House Agriculture Committee Chairman GT Thompson (R-PA), which made line edits to the decentralized finance activities exempted under the Commodity Exchange Act in Section 409.

Prior to the managers amendment, members of the DeFi community expressed concerns about the last-minute edits made to Sections 309 and 409 to narrow the exemptions to certain activities related to technology involved in spot digital commodity transactions (as opposed to any type of transaction). The Hill-Thompson manager’s amendment (#47) was adopted as part of the final bill text passed by the House of Representatives, a partial victory for the DeFi community.

House Floor Statements on CLARITY & DeFi

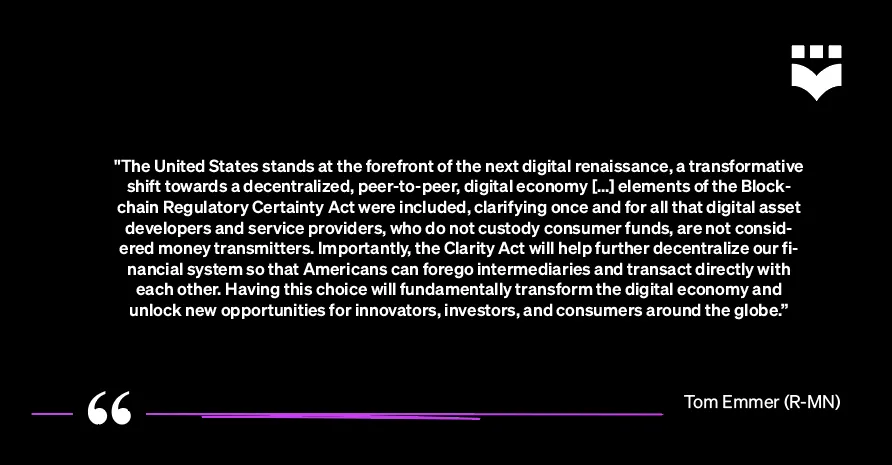

Importantly, the bill managers, HFSC Chairman French Hill (R-AR), House Agriculture Committee Chairman GT Thompson (R-PA), and GOP Majority Whip Tom Emmer (R-MN) delivered key speeches on the House floor expressing the congressional intent related to how the CLARITY Act treats DeFi.

Chairman Hill acknowledged in his floor remarks that "decentralized finance or DeFi developers do not take custody of user assets, nor do they control user assets. Therefore, we should not treat them in the same way we treat centralized actors who do have custody, who do have control over assets.”

In a later floor statement, House Agriculture Committee Chairman GT Thompson stated that "Congress is making an unambiguous statement that DeFi is different and it should be treated differently from centralized, custodial intermediaries. Protecting this emerging technology is an essential purpose of the CLARITY Act."

DEF’s Perspective

DeFi Education Fund appreciates the efforts of the bill’s sponsors, HFSC Chairman Hill and House Ag Chairman Thompson, as well as a bipartisan group of 20 cosponsors, and the dedicated staff – all of whom wrestled with the complex issues surrounding digital asset regulation.

As market structure legislation moves to the Senate, DEF remains committed to ensuring that DeFi developers, users, and technology are accurately represented and appropriately considered. Additional work is needed to ensure that the final law provides robust protections for DeFi. DEF remains committed to working with lawmakers to improve the bill so that it reflects the realities of DeFi technology and supports innovation, security, and individual autonomy. To read DEF’s full statement on the passage of CLARITY, click here.

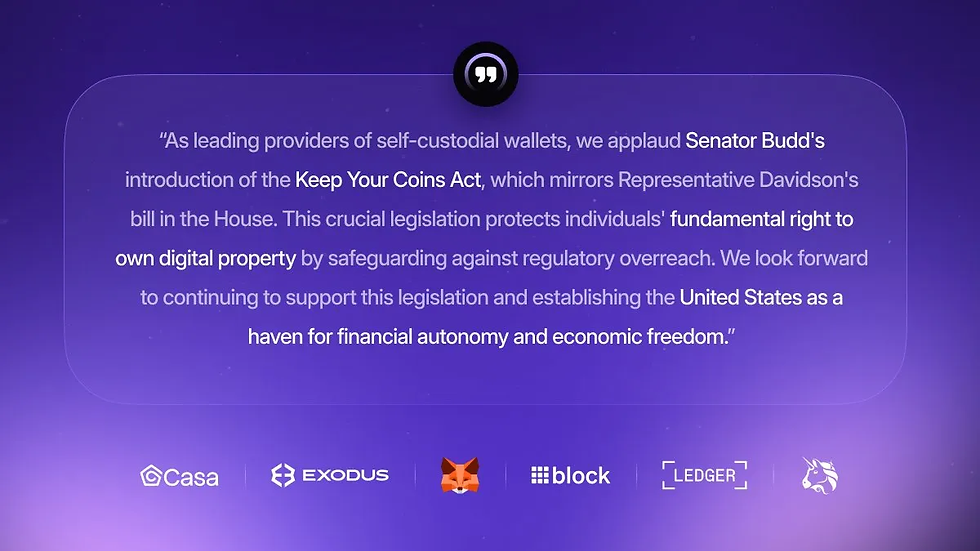

Senator Budd Reintroduces the Keep Your Coins Act

On July 15, 2025, U.S. Senator Ted Budd (R-NC) was joined by Senator Mike Lee (R-UT) in reintroducing the Keep Your Coins Act (KYCA). Senator Budd previously introduced the Keep Your Coins Act in the Senate in 2023. The purpose of the act is to prevent the federal government from restricting or infringing an individual's right to self-custody their own assets.

The Keep Your Coins Act offers stronger and more explicit protections for all U.S. persons than those currently in the CLARITY Act, which includes select provisions for self-custody. In Section 105, it affirms that individuals in the U.S. shall “retain” the right to use hardware or software wallets for personal digital assets and to conduct lawful, peer-to-peer transactions with non-financial entities, provided the transactions don’t involve sanctioned assets and the individual isn’t acting on behalf of others.

However, the KYCA prohibits federal agencies from restricting or infringing on a person's use of self-hosted wallets or digital currencies, which provides clearer and more enforceable protections for self-custody. The KYCA prevents the federal government from interfering with U.S. person’s ability to self-custody their own funds and from surveilling transactions in the digital asset ecosystem by:

Prohibiting any federal agency from promulgating a rule that would impair an individual’s ability to self-custody their own funds;

Protecting an individual’s right to conduct peer-to-peer transactions without the need to use a third-party intermediary; and

Empowering individuals to maintain control over their digital assets through self-hosted wallets to ensure financial freedom and a decentralized cryptocurrency ecosystem.

There is hope that the KYCA will be included in the Senate's version of digital asset market structure legislation, which would provide stronger self-custody protections. DEF strongly supports the addition of KYCA to future digital asset market structure legislation. You can read the full bill text here.

Senate Ag Hearing on Digital Asset Market Structure

On July 15, 2025, the Senate Committee on Agriculture, Nutrition, and Forestry held a hearing entitled “Stakeholder Perspectives on Federal Oversight of Digital Commodities.” The witnesses included Ji Kim, President and Acting CEO of Crypto Council for Innovation; former CFTC Chairs Rostin Behnam and Timothy Massad; Walt Lukken, President and CEO of FIAconnect; and Tom Sexton, CEO of NFA News. Lawmakers debated the scope of the CLARITY Act and how to regulate centralized exchanges and international trading platforms. Senator Klobuchar also questioned witnesses on how DeFi should be approached under the Senate’s market structure legislation.

As the Senate embarks on their market structure efforts, DEF remains committed to ensuring that DeFi developers, users, and technology are accurately represented and appropriately considered. Stay tuned for updates from Team DEF.

House Ways and Means Oversight Subcommittee Hearing

On July 16, 2025, the House Ways and Means Oversight Subcommittee hosted a committee hearing entitled “Oversight Subcommittee Hearing on Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century.” The House Ways and Means Committee retains jurisdiction over federal tax policy, and played an instrumental role in Congress’s recent resounding bipartisan supermajority Congressional Review Act vote to protect DeFi protocols from IRS overreach.

The witnesses included Summer Mersinger, CEO of the Blockchain Association; Sarah Reilly, Vice President and Senior Tax Counsel for Fidelity Investments; Alison Mangiero, Head of Staking Policy and Industry Affairs at the Crypto Council for Innovation; Jason Somensatto, Director of Policy at Coin Center; and Corey Frayer, Director of Investor Protection at the Consumer Federation of America. The hearing focused on creating a clear tax policy framework for digital assets, addressing industry concerns about regulatory uncertainty, and exploring industry-friendly policies to foster blockchain innovation.

Notably, Representative Max Miller (R-OH), a member of the House Ways and Means Committee and a prominent leader on DeFi policy, announced plans to release draft legislation outlining a tax framework for digital assets. The framework would establish a de minimis standard that would exempt small crypto transactions from taxes. The bill would also clarify the tax implications for common crypto activities like mining and staking.

U.S. vs. Roman Storm Trial Begins in Manhattan

On July 14, 2025, Roman Storm’s trial kicked off in the Southern District of New York Courthouse. In August 2023, the Tornado Cash developer was indicted by the U.S. Department of Justice (DOJ) on several charges, including conspiracy to commit money laundering, conspiracy to violate sanctions, and conspiracy to operate an unlicensed money transmitting business. This case could set precedent on whether software developers can be held legally responsible for how others use their code. For an in-depth background on the case, read DEF’s blog here.

DEF team members will be attending the trial over the next few weeks. On July 15, DEF’s Chief Communications Officer attended jury selection, and she explained that the legal teams selected 12 jurors (7 women, 5 men) and 4 alternates, before opening statements began and Storm’s defense asserted: “It is not a crime to make a useful thing that is misused by bad people.” Government witnesses have been testifying since then and will continue for this week.

The DEF team will continue to highlight trial updates on X and in this newsletter. The Rage will also be providing day-to-day coverage here.

DeFi Dictionary Word of the Week

The CLARITY Act represents a purposeful effort to distinguish between DeFi and centralized intermediaries, and it's the inspiration for our Word of the Week: Intermediary.

Notable and Quotable

.png)

Comments